- More than 70% of UK digital asset investments now back B2B firms, a sharp rise from 27% in 2015

- Equity funding patterns have become detached from Bitcoin price cycles, signalling a more stable, fundamentals-driven market

- With 23 million users — around 35% of adults — the UK remains Europe’s most active digital asset market

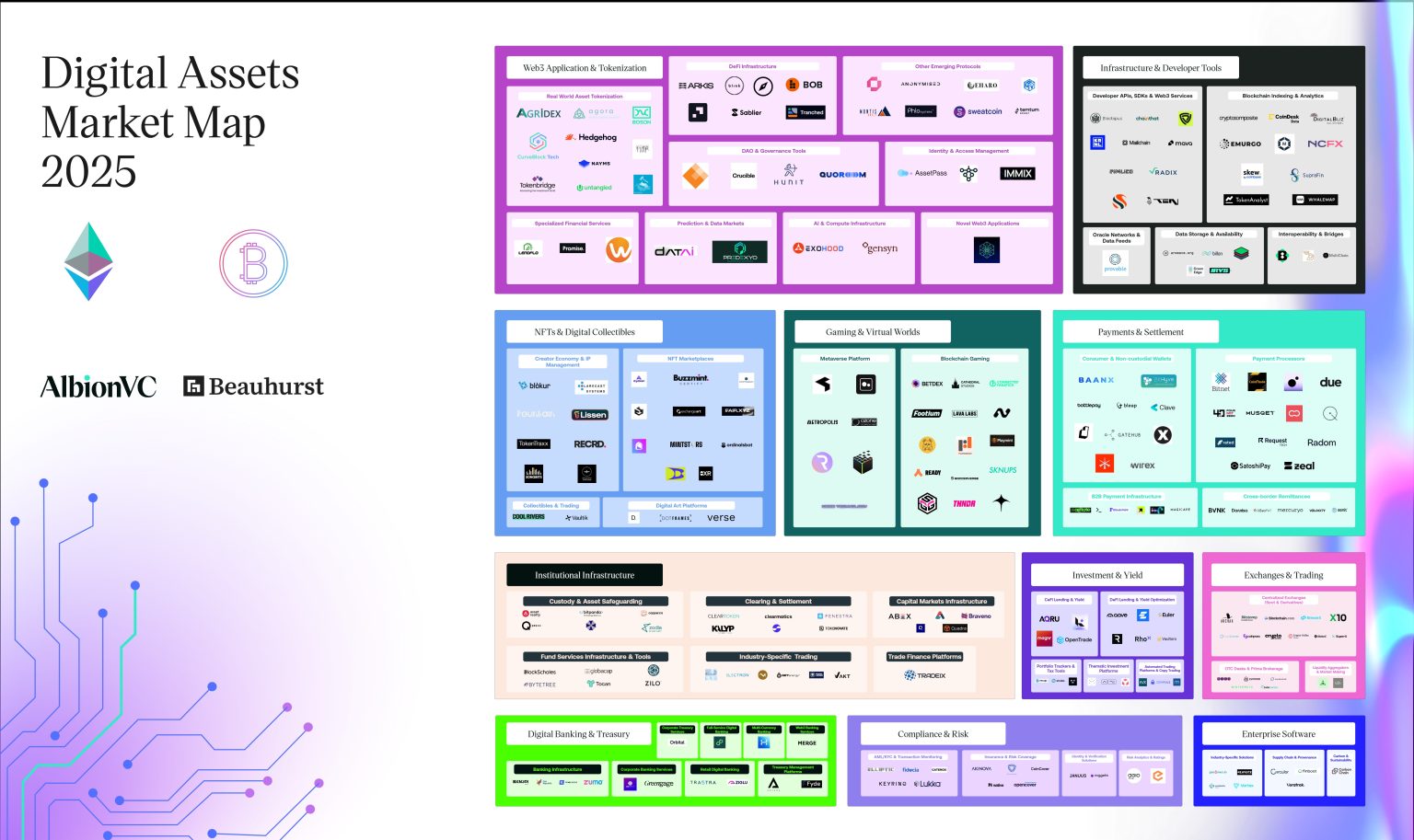

New analysis from AlbionVC indicates that the UK’s digital asset sector has moved decisively into a more advanced phase, with capital increasingly flowing into companies developing institutional and enterprise-grade infrastructure rather than consumer-facing applications.

The Digital Assets Report 2025, which reviews more than 1,400 UK digital asset start-ups launched since 2015, shows that business-to-business models now account for over 70% of investment activity in the field, compared with just 27% a decade earlier. This marks a shift away from retail-focused innovation towards regulated, institutional blockchain solutions supporting financial markets, payments systems, and compliance frameworks.

The report also highlights three emerging areas of UK specialisation where regulatory, legal, and financial strengths offer a distinctive international advantage: Institutional Blockchain Services, Regulatory Technology Export, and Corporate Tokenisation Infrastructure.

This evolution is already reflected in major national initiatives, including the London Stock Exchange Group’s Digital Markets Infrastructure, HM Land Registry’s Digital Street programme, and the Bank of England’s Project Meridian — all demonstrating how blockchain technology is progressing from pilots to live deployment within regulated financial environments.

Jay Wilson, Partner at AlbionVC, said: “The UK has assembled the building blocks of a mature digital-assets ecosystem: regulatory clarity, deep financial infrastructure and institutional trust. The opportunity now lies in strategic specialisation: focusing on areas like institutional blockchain infrastructure, regulatory technology and corporate tokenisation. These are the segments where a new generation of world-class founders are already building platforms that bridge traditional finance and the digital asset economy, and where the UK is best placed to lead the way globally”.

Investment patterns reflect market maturity

The data also shows that the UK’s digital asset market has decoupled from Bitcoin price cycles for the first time. Despite Bitcoin hitting a record $126,223 in 2025, UK startups raised £100 million in H1 2025, the lowest since 2020, as investors increasingly focus on fundamentals such as regulated revenue, enterprise contracts, and defensible IP.

This maturity is also reflected in capital flows. While UK firms have raised £2.7 billion to date, funding is concentrated in high-value segments. Capital markets have attracted £896 million since 2015, more than double the next largest sub-segment, while banking and infrastructure lead in highest average deal size (£8.9 million and £7.8 million, respectively), signalling investor preference in institutional-grade platforms.

These trends are reflected in the UK’s top-funded companies:

- Blockchain.com: £425m – trading & custody infrastructure

- Copper: £238m – institutional custody & settlement

- Exohood Labs: £232m – blockchain infrastructure & AI technology

- Elliptic: £79m – blockchain analytics & compliance

UK regulatory framework supports growth

The report comes as the UK strengthens its regulatory base with a phased FSMA-based crypto regime, bringing exchanges, stablecoins, and custodians under a unified framework, and lifting the four-year retail ban on crypto exchange-traded notes. Alongside the launch of the Transatlantic Task Force for Markets of the Future with the US, these reforms underscore the UK’s agility and growing influence in shaping global digital-asset policy.

Strong legal foundations – including common law, the Digital Assets Bill 2025, and alignment with global AML and sanctions standards – also provide a trusted environment for institutional adoption. However, structural challenges remain: half of UK crypto firms face banking-access issues, and the FCA’s full digital-asset regime is not expected until 2026–27.

Market and talent positioning

With 23 million users (35% of adults), Europe’s highest adoption rate, and a third of the continent’s blockchain talent, the UK combines institutional expertise and emerging infrastructure to compete in specialised, high-value areas like institutional blockchain, regulatory technology exports, and corporate tokenisation infrastructure, rather than broad-spectrum competition.